October 2025 Phoenix Arizona Real Estate Snapshot

Sales Are Up 19% in This Price Range

Prices Are Down 15% in These Segments

For Buyers:

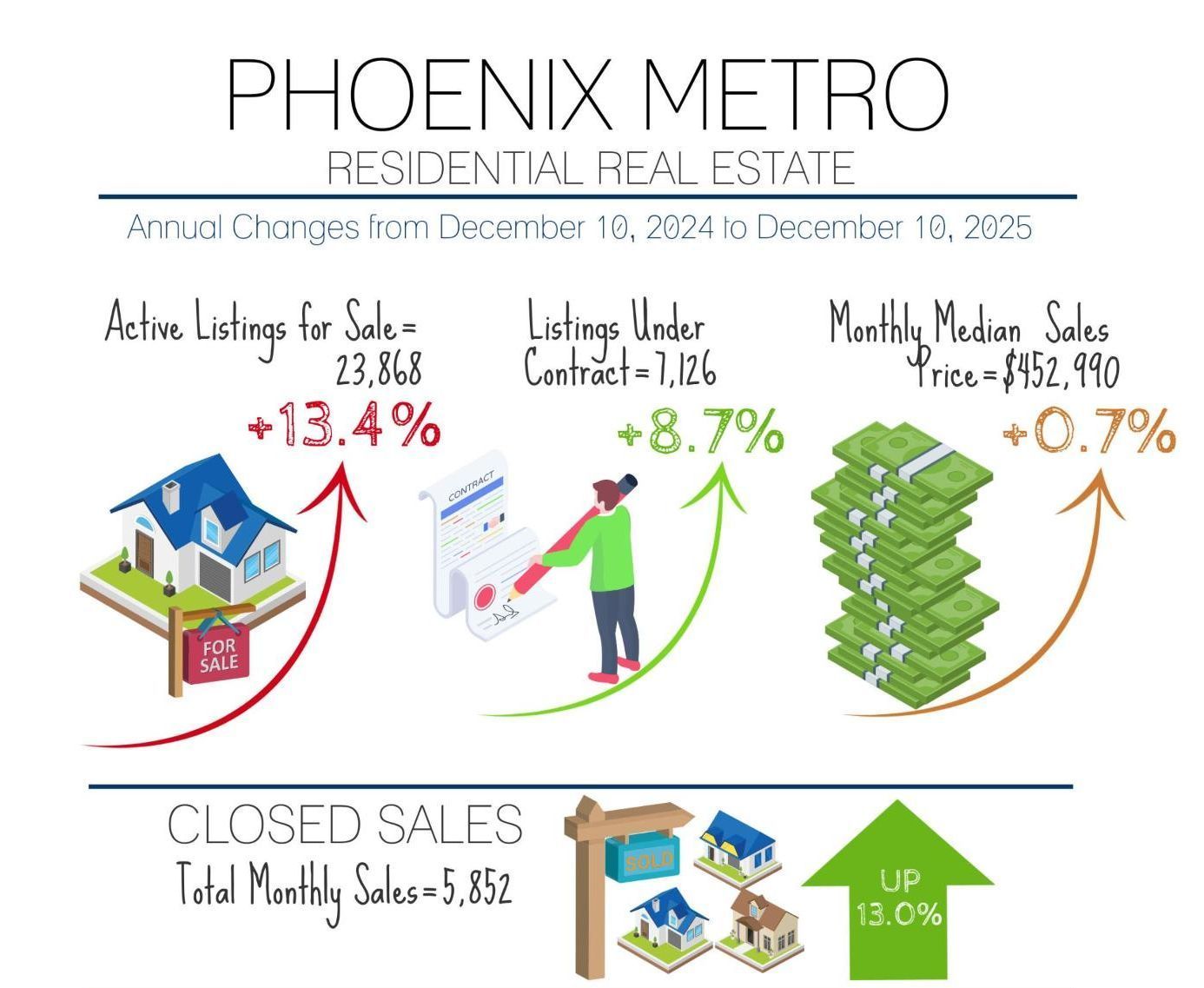

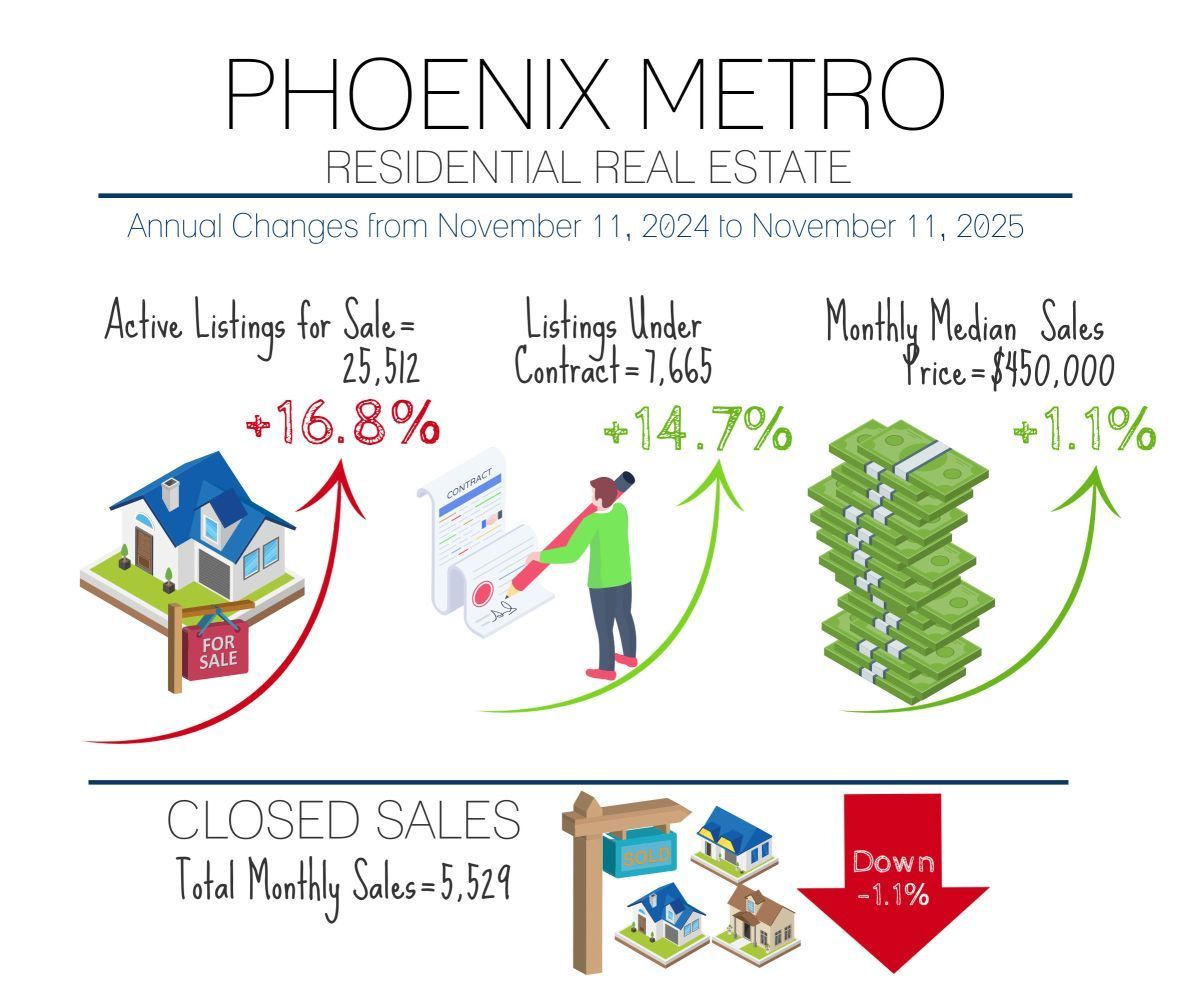

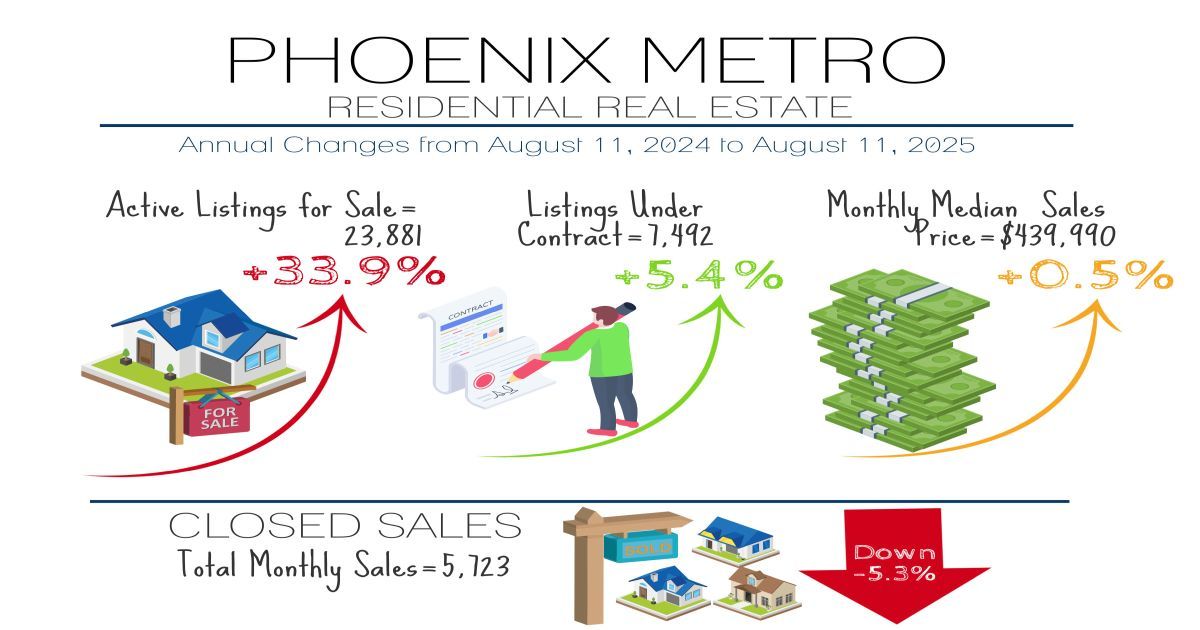

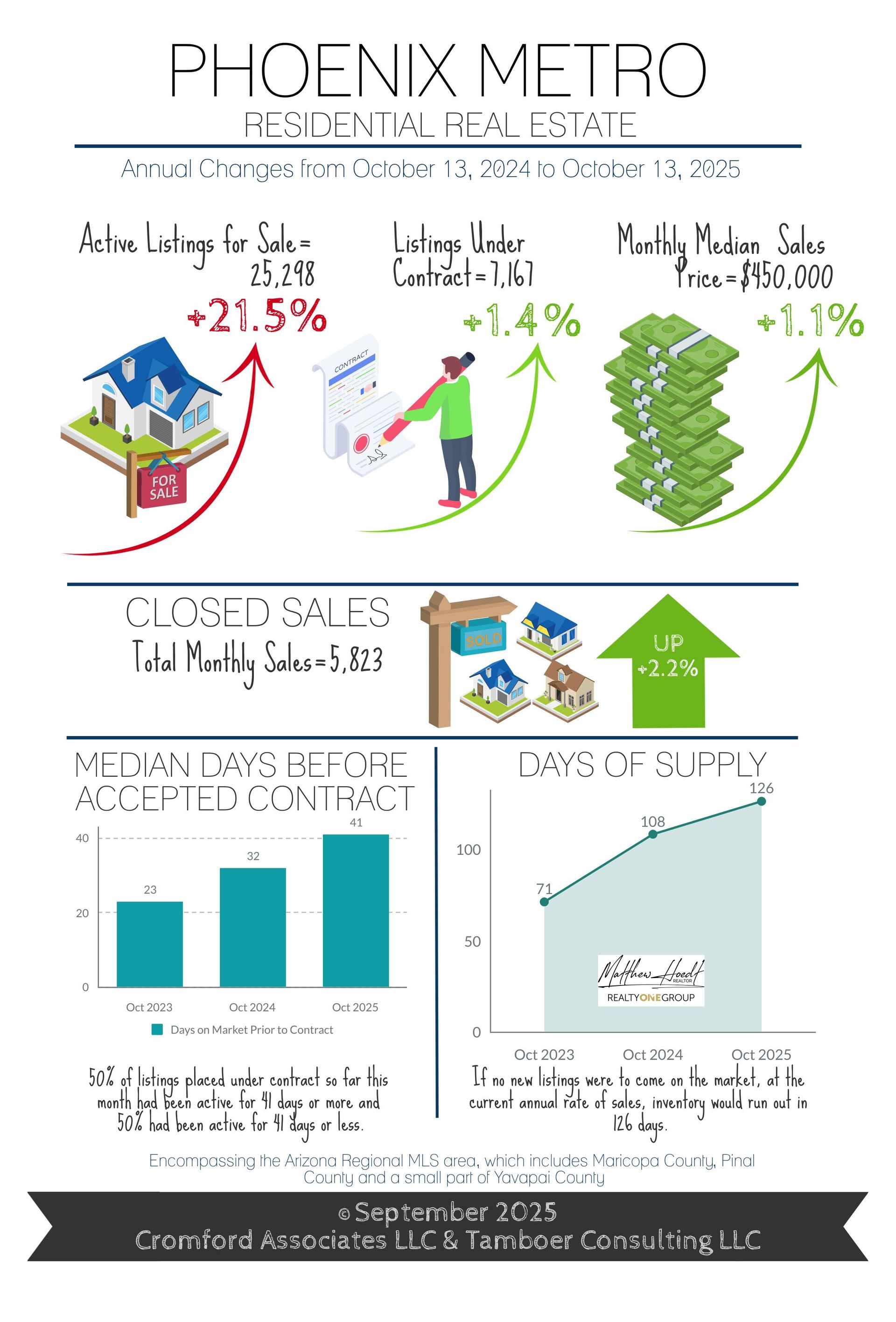

Mortgage rates dropped over 2 months from July 15th (6.85%) to September 16th (6.1%), lowering payments by 7.5% across the board and reaching the lowest rate in over a year. Real estate professionals swung open the gates and awaited a stampede of buyers to arrive. But, while there was a wave of refinances, purchase applications were stubborn. This is a common phenomenon. While rates are actively dropping, it’s human nature to wait and see where they stabilize before taking action, hoping to save even just a few extra dollars off a payment. Rates ultimately bounced and settled around 6.3%, and after 3 weeks of stability buyer activity finally ticked up to a level better than the past three years for October.

Mortgage rates weren’t the only measure dropping over the past 5 months, so were list prices. Listings under $1M saw asking prices drop an average of 2.5% from May to August, then stabilized in September and October. These properties do not yet have contracts on them, but when they do they will likely be closing in November and December, and possibly at the lowest closing price recorded all year.

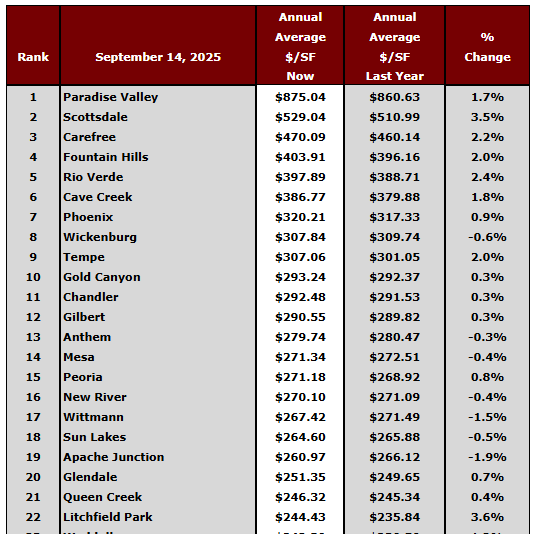

The biggest price declines have been seen in the first-time homebuyer price ranges. Since July, sales prices for condos between $250K-$300K in Maricopa County (around 1,000sqft) have dropped 4.3% and are 15% below the peak prices of 2022. Single family homes in Pinal County between $300K-$400K (around 1,700sqft) are down 6.7% from last April, and are also 15% down from the peak of 2022. Single family homes in Maricopa County between $300K-$400K (around 1,500sqft) are down 2.9% from last year and down 13% from the peak of 2022. All of this is happening while the overall median price measure is showing just a mild increase year-over-year for the metro area, and just 4.5% below the peak of 2022. This is a prime example of how broad price measures spanning a large area are not always reflective of specific segments and can be skewed by better performing areas and price ranges.

Seller-paid concessions hit another high for September with 56% of MLS closings involving some form of closing cost assistance at a median cost of $10,000, which often includes a temporary rate buydown. This has been a unique hallmark of this housing cycle since rates skyrocketed in 2022. A tool typically used by builders to incentivize buyers has been adopted by everyday sellers and lenders in the resale market in order to compete. As appreciation has been stunted for the past 3-4 years and values declined this year, the number of sellers who can shoulder the cost of these incentives may diminish going forward.

If lower prices, lower mortgage rates, and a high share of seller incentives isn’t enough, seasonally the 4th quarter is the best time to be a buyer in Greater Phoenix. Supply tends to rise right before the holidays, but the rush of buyers doesn’t follow until after the 1st of the year. As a result, there’s a last hurrah of price reductions before Thanksgiving followed by heavier price negotiations and builder incentives as sellers aim to get under contract or close before the end of the year.

It’s common for buyers to get caught up waiting for evidence that it’s the “perfect time” to act, and delaying an affordable purchase in order to land some unicorn price and mortgage rate. Real estate is typically a long-term investment, however. The longer one holds a property, the more equity is built, appreciation accumulated, and risk of loss mitigated.

For Sellers:

This year has been a slog for sellers (and their agents) to say the least with stock market fluctuations at the beginning of the year stalling luxury sales, and volatility in mortgage rates. But there are signs things have gotten better. Lower mortgage rates and lower prices have stimulated demand in unexpected places. While homebuyer demand between $300K-$500K has been anemic, homes between $500K-$1.5M saw a boost of sales in September, up 19% year-over-year, which increased the market share from 36% to 38% of sales, and increased both the median price and average price per square foot measures for the Valley. The reason could be linked to jumbo mortgage rates dropping below 30-year conventional rates for the first time in 2 years, but also the popularity among high-wage buyers of adjustable-rate mortgages, which are currently averaging 5.8%.

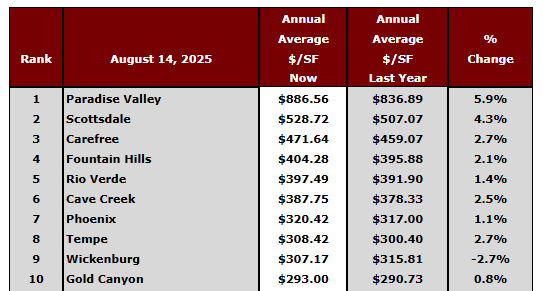

While Greater Phoenix remains in a buyer’s market overall, the Northeast Valley including Fountain Hills, Paradise Valley, and Scottsdale are top seller’s markets, reflecting a drop in supply and sustained demand in these cities. Also seller’s markets: Anthem, El Mirage, Avondale, Chandler, Gilbert, Apache Junction, and Sun Lakes. Balanced markets include Phoenix, Glendale, Sun City West, Tolleson, Mesa, and Tempe. Buyer’s markets are mostly on the edges and outskirts where there is more new home development. They include Peoria (barely), Sun City, Surprise, Goodyear, Litchfield Park, Laveen, Buckeye, Gold Canyon, San Tan Valley, Queen Creek, Maricopa, Arizona City, and Casa Grande.

The 4th quarter is not the best time to be a seller, but going in with the right mindset, patience, and price strategy will go a long way towards obtaining a contract before the end of the year. For those who wish to wait, the 1st quarter comes with both a wave of new competing listings from January through March, and increased contract activity that lasts through May.